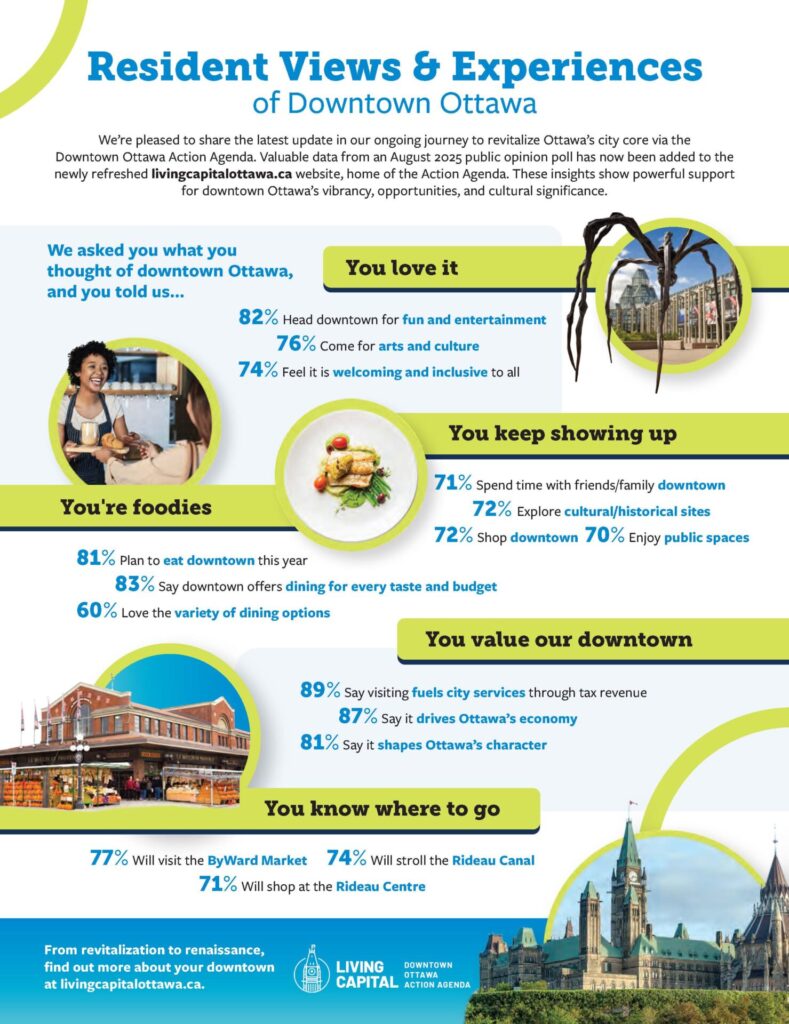

Small Businesses: Ottawa’s Lifeblood

OTTAWA IS “SMALL BUSINESS STRONG.” A full 92.5 per cent of Ottawa’s 30,900 active businesses are considered small—meaning fewer than 99 employees—and most of them, nearly 60 per cent, are defined by the Canadian Chamber of Commerce (CCC) as “micro businesses,” which means they employ one to four people. That leaves just 703 of the city’s corporate entities as larger companies—those that employ more than 100 employees.

As such, there’s no question the city is full of entrepreneurs who are driven by their business savvy, creativity and innovation, and who may also benefit from the city’s many support systems and programs, whether they be those of the National Research Council, Invest Ottawa or the province. But this year has been a “challenging” one in Ottawa, according to the CCC’s Business Data Lab. Data from May 2024 shows 1,201 new businesses opening—a figure that is down by 16.3 per cent from the same time last year—and a full 1,266 businesses closing over the same period, up by six per cent over 2023. Of those closures, 1,035 were the smaller companies—the lifeblood of the economy.

Nevertheless the tech sector, says Sonya Shorey, president and CEO of Invest Ottawa, is thriving in Ottawa.

“Our [tech sector] entrepreneurship ecosystem is on fire,” Shorey says. “It is thriving. Where across the country, statistics are showing that there’s a lower number of entrepreneurs starting new businesses, in Ottawa, we’re seeing the opposite momentum. There is a disproportionate growth that we’re seeing in our city.”

Shorey warns that not all of those startups will survive but says it shows there is “there is a genuine entrepreneurial momentum that’s very exciting to us.”

“Our [tech sector] entrepreneurship ecosystem is on fire. Where across the country, statistics are showing that there’s a lower number of entrepreneurs starting new businesses, in Ottawa, we’re seeing the opposite momentum.”

SONYA SHOREY, PRESIDENT AND CEO OF INVEST OTTAWA

By the numbers

By the numbers Marwa Abdou, senior research director at the Canadian Chamber of Commerce, has just completed a study titled, A Portrait of Small Business in Canada: Adaption, Agility, All at Once.

“An interesting aspect is that the bulk of [Canada’s small businesses] are in the four most populous provinces of Canada— Ontario, Quebec, British Columbia and Alberta,” Abdou says. “That’s not entirely shocking, but if you actually examine the number of businesses per capita, that distribution differs, so adjusting for vast population differences across the provinces actually shows that there are more businesses located in places like Yukon, Prince Edward Island and Western Canada.”

Abdou says that in terms of industry distribution, 40 per cent of small businesses in the country are concentrated in construction, health care, professional services and other services. Another discovery she made in producing the report is that immigrants are a huge driving force in small business in Canada. “At this moment in time, given that we’re at the highest immigration rate on record, this is particularly important when you’re thinking about how immigrants are settling into the country, how they’re actually contributing to the economy. Where are some of the missed opportunities? Are they fully being utilized in terms of their innovative and diverse background and prowess in terms of entrepreneurship, their ability to be agile in starting up their own businesses and really contributing to Canada’s economy.”

A snapshot of Ottawa’s largest small business sectors

Business Development Bank of Canada (BDC) has a highly detailed breakdown by sector of Ottawa’s small business numbers. Some of the larger sectors—in terms of the numbers of businesses in them—are in keeping with the findings in the CCC’s report. The largest sector is made up of companies in the professional, scientific and technical services, with a total of 7,039 companies as of June 2024. That includes companies that provide legal, accounting, architectural, engineering, design, scientific research, advertising and public relastions services, among others. The health care and social assistance sector comes next with 5,116 companies, including doctor and dentist offices, diagnostic and laboratory service offices, health and home care clinics. Construction is also big with 5,032 companies, being put to work all over the city and working on projects small and large, including the new Civic Hospital, the new public library, CHEO’s expansion and the Parliamentary precinct project to name a few. For more details and numbers, see the infographic on pages 26 and 27.

Local campaigns

In addition to supports from all levels of government, organizations such as the Ottawa Board of Trade and partners, including Invest Ottawa, the City of Ottawa, Ottawa Tourism, the Ottawa Coalition of BIAs and Regroupement des gens d’affaires de la Capitale, have initiated campaigns such as #BuyLocalOttawa, which calls on residents of the National Capital Region to become part of the city’s economic recovery and rebound plan by buying local now, and over the holiday season. The campaign suggests buying as much as possible from local businesses and encouraging others to do the same; promoting your favourite local businesses on social media; taking photos when you’re buying local and then posting them with the campaign hashtag. It also asks residents to be patient and kind as many businesses are still short-staffed.

“The #BuyLocalOttawa campaign is a reminder to everyone that businesses drive our local economy, enhance our community culture and shape our future,” the campaign material says. “They support all of us. So now it is time to support them.”

Small Business Week—which takes place each year during the third week in October, this year Oct. 20 to 26—is another such initiative that brings together entrepreneurs and celebrates their contributions to their communities. Launched by BDC 45 years ago, it’s an annual entrepreneurship event that brings together more than 10,000 of Canada’s 749,000 entrepreneurs to learn, network and celebrate what Canada’s 1.2 million small and medium-sized businesses (SMEs) contribute to the economy, including making up 48 per cent of Canada’s gross domestic product. SMEs in the country are responsible for 43 per cent of exports and these businesses account for 63.8 per cent of private-sector jobs. Further, across Canada, 34 per cent of entrepreneurs are immigrants, 28 per cent identify as a visible minority and 26 per cent are women.

How small business contributes

“Small businesses bring opportunities. They bring opportunities for people to live, work and play in a specific area and in any community. Generally, it’s the housing that goes in first, but the community really starts to flourish when small business sets up there.”

PRIYA BHALOO, VICE-CHAIR OF THE OTTAWA BOARD OF TRADE AND OWNER OF TAG HR

One of those women in business is Priya Bhaloo, vice-chair of the Ottawa Board of Trade and owner of Tag HR. She’s thought a lot about the role of small business, beyond its economic contributions, to the community.

“So small businesses bring opportunities,” she says. “They bring opportunities for people to live, work and play in a specific area and in any community. Generally, it’s the housing that goes in first, but the community really starts to flourish when small business sets up there.”

Bakeries, grocery stores, restaurants and convenience stores, for example, allow people to do everything they need to do in their own neighbourhoods. And, Bhaloo notes, business improvement associations and other business organizations contribute much in terms of community events and even community rebuilding.

“The Ottawa Board of Trade has taken the lead on the revitalization of downtown project and although the decline of downtown is being felt by everyone, it did take businesses to come together and put together a solid action plan,” she says. Andrew Abraham, CEO and founder of TAAG, a multidisciplinary professional service firm, says small business is the very essence of community.

“The contractors, restauranteurs, and fitness and beauty professionals make up the fabric of our community,” Abraham says. “Small businesses create a unique culture. They influence how we gather and socialize. And they play a huge role in connecting people.” Speaking about the challenges businesses are facing at the moment, Bhaloo says the economic climate is challenging. “Access to financing and capital is much more difficult now than it was maybe 15 years ago. And interest rates play into absolutely everything so the cost of everything is going up.”

“The contractors, restauranteurs, and fitness and beauty professionals make up the fabric of our community, small businesses create a unique culture. They influence how we gather and socialize. And they play a huge role in connecting people. The reality is that people need to support local businesses.”

ANDREW ABRAHAM, CEO AND FOUNDER OF TAAG

Abraham agrees but says small business owners are “the most resilient people” and he sees them all the time at his firm.

“They are not afraid to restructure and reset,” he says. “Our clients are still willing to take risks to build a successful business. Small business owners have faced enormous challenges over the past four years, but many are still here.”

Says Abraham: “The reality is that people need to support local businesses. Small business owners want to get back to work. We need to support them. They are the lifeblood of our community.”

Shorey agrees. “Our small businesses, our main streets, they really create and drive our quality of life,” she says.